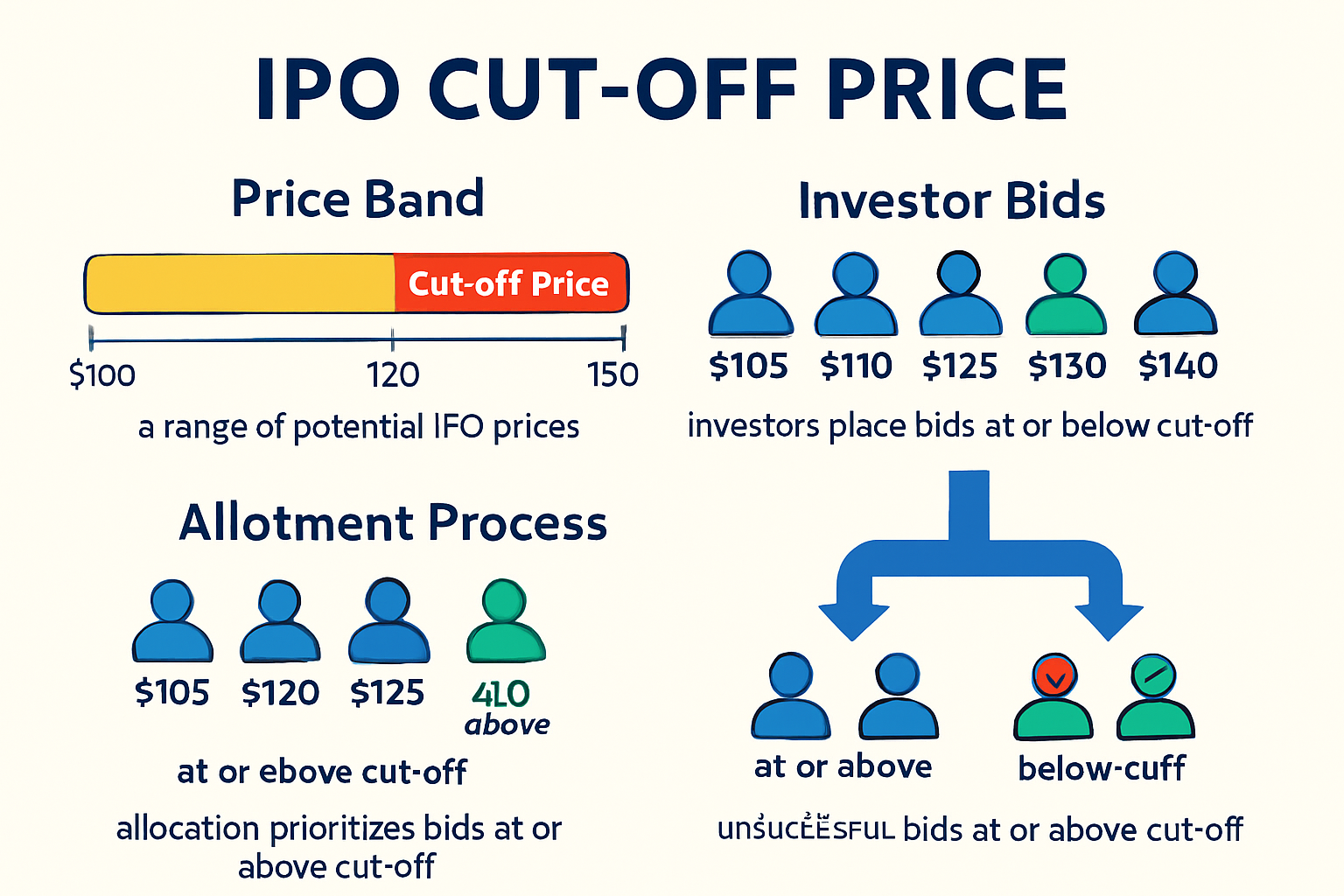

What Is Cut-Off Price in IPO?

In an IPO (Initial Public Offering), the cut-off price

is the final price at which shares are allotted to investors. It is determined

after the bidding process closes and represents the price within the specified

price band at which total demand matches the number of shares offered.

When applying for an IPO under the book-building

method, investors can:

- Select

a price within the price band.

- Or

choose the cut-off price option.

Choosing the cut-off price means the investor agrees to pay

any price within the price band that is finalized by the company after demand

analysis.

How Does the Cut-Off Price Work?

Suppose a company issues shares with a price band of ₹200 to

₹210.

- If

you apply at a price of ₹205 and the final issue price (cut-off price) is

₹210, you may not get allotment because your bid was below the

cut-off.

- If

you apply at the cut-off price, you agree to pay up to ₹210 and are

eligible for allotment regardless of the final price within the band.

- If

the final price is ₹205 and you applied at the cut-off (₹210), you will

pay ₹205 and get a refund of the difference.

Why Is Cut-Off Price Important?

- It facilitates

fair price discovery: The cut-off price is based on investor demand

and market conditions.

- It

ensures fair allocation: Investors bidding at or above the cut-off

price have higher chances of getting shares.

- It

helps investors participate in the entire price band: Choosing

cut-off price shows willingness to pay the final issue price.

- It's

mostly available to retail investors; institutional investors have

to bid at specific price levels.

Tips for Investors Applying at Cut-Off Price

- Applying

at cut-off price increases chances of allotment.

- For

retail investors, choosing cut-off is a simpler option preventing

rejection due to bid price lower than final price.

- However,

applying above cut-off price can increase allotment chances but

block more funds.

- Always

consider your risk appetite and financial planning before bidding.

Conclusion

Understanding the cut-off price helps investors apply wisely

in IPOs to improve their allotment chances and avoid rejection due to lower

bids. It is a critical tool that bridges company valuation and investor demand

transparently in book-building IPOs.