Introduction

to Mutual Funds

A mutual

fund is a professionally managed investment scheme that pools money from

various investors to buy a diversified portfolio of securities such as stocks,

bonds, or other assets. It’s one of the easiest ways for beginners to start

investing and build wealth over time.

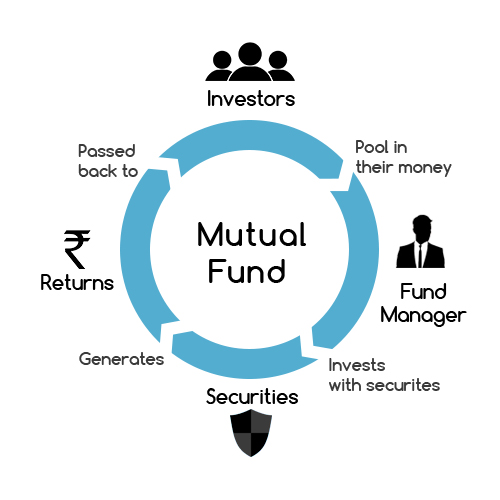

How Do

Mutual Funds Work?

When you invest in a mutual fund, your money is combined with other investors’ money. A fund manager then uses that pool to buy a diversified portfolio according to the fund’s objective. The profits (or losses) from this portfolio are distributed among investors in proportion to their investment.

Key

Benefits:

- Diversification: Reduces risk by investing in

multiple assets.

- Professional Management: Fund managers handle

investment decisions.

- Liquidity: You can buy/sell mutual fund units with ease.

- Regulated Investment: Governed by SEBI in India or SEC in the U.S.

Types of

Mutual Funds

Understanding

different types of mutual funds helps align your investment with your

financial goals.

|

Type |

Description |

|

Equity

Mutual Funds |

Invest

primarily in stocks; higher returns but higher risk. |

|

Debt

Mutual Funds |

Invest in

fixed-income instruments like bonds; safer, with moderate returns. |

|

Hybrid

Funds |

Mix of

equity and debt; balanced risk and reward. |

|

Index

Funds |

Track a

market index like Nifty 50 or S&P 500; passive investing. |

|

ELSS

Funds |

Tax-saving

equity funds under Section 80C in India. |

Why

Invest in Mutual Funds?

Mutual funds

are ideal for both new and seasoned investors due to their flexibility and

transparency. Here's why millions prefer them:

- Start with Low Capital: SIPs start from as low as

₹500/month.

- Compound Growth: Long-term investments lead to

wealth creation.

- Tax Benefits: ELSS schemes provide

deductions under income tax laws.

- Goal-Based Investing: Choose funds for retirement,

education, or home buying.

SIP vs.

Lump Sum Investment

A Systematic

Investment Plan (SIP) allows you to invest a fixed amount regularly,

reducing the risk of market volatility. On the other hand, lump sum

investment works well when the market is down, and you have surplus funds.

Pro Tip: For beginners, starting with a SIP in a balanced or index mutual fund is often a wise strategy.

How to

Choose the Right Mutual Fund?

When picking

a mutual fund, consider these factors:

- Your Risk Profile: Conservative or aggressive?

- Investment Horizon: Short, medium, or long-term?

- Fund Performance: Check historical returns (3,

5, and 10 years).

- Expense Ratio: Lower is better.

- Fund Manager Track Record

Tools and

Platforms to Invest

You can

invest in mutual funds through:

- Directly via AMC websites

- Online platforms like Groww, Zerodha, Kuvera, Paytm Money

- Through your bank or financial advisor.

Conclusion:

Start Investing Today!