Introduction

The Indian IPO market in 2025 has been electric, with over

₹51,150 crore raised in the first half of the year and more than 220 public

listings. Yet, only selective IPO picks have outperformed, turning investors

into winners even amid broader market caution. This post examines the year's

major gainers and notable losers, highlighting the top trends, sectors, and

smart strategies for IPO investing in India.

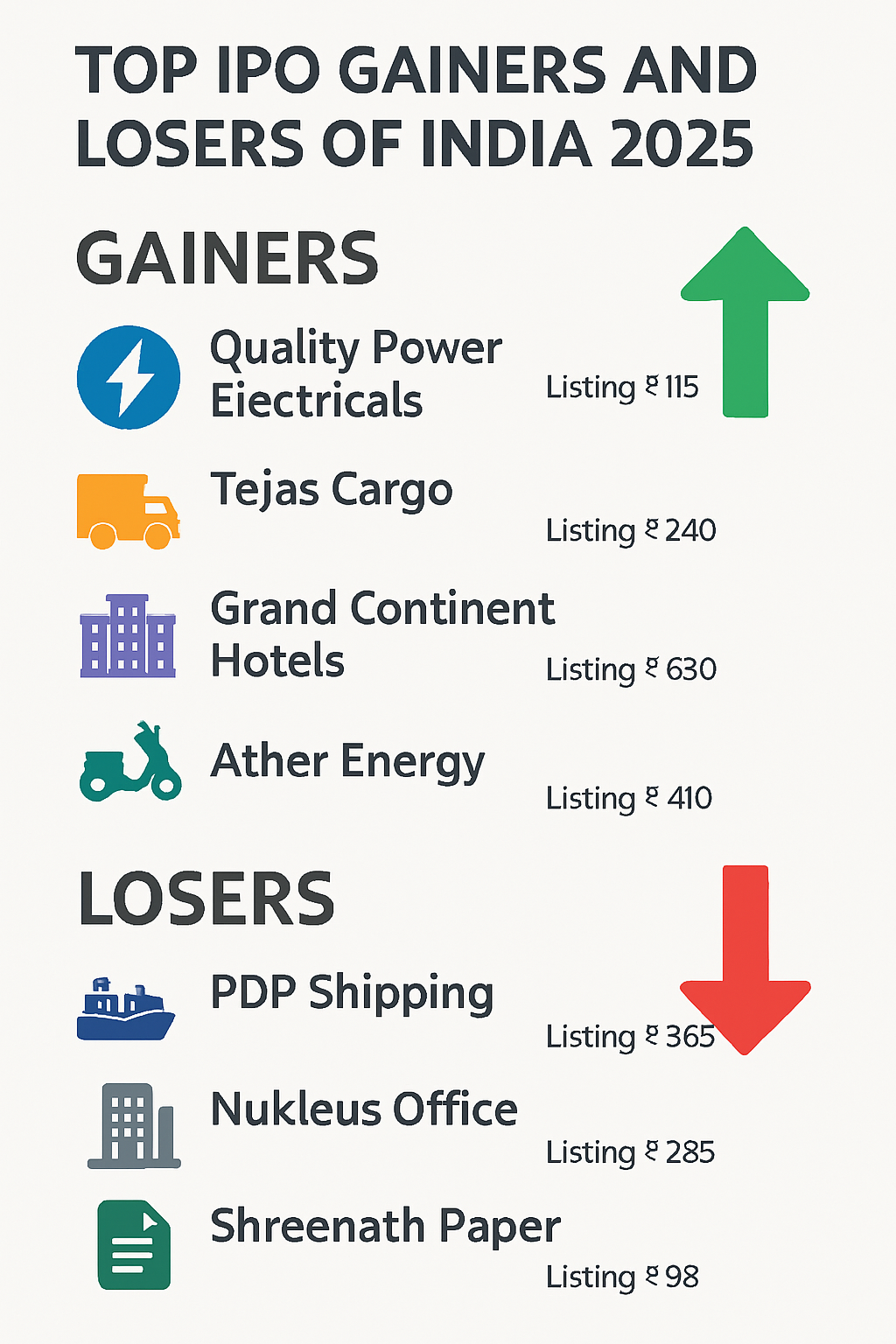

Major IPO Gainers of 2025

Some IPOs have dazzled investors by delivering strong

returns post-listing, even those that debuted at discounts. Here are four

standout successes:

- Quality

Power Electrical Equipment Ltd

- Issue

Price: ₹425

- Listing

Price: ₹387 (8.7% discount)

- Current

Price: ₹784

- Gain:

84%

- Strength:

Revenue up 187% YoY; robust EBITDA and profit growth

- Tejas

Cargo India Ltd

- Issue

Price: ₹168

- Listing

Price: ₹168

- Current

Price: ₹279

- Gain:

66%

- Strength:

Riding India’s logistics boom with surging revenues and net profits

- Grand

Continent Hotels

- Issue

Price: ₹113

- Listing

Price: ₹107.3 (5% discount)

- Current

Price: ₹147.10

- Gain:

~59%

- Strength:

Aggressive growth in revenue and expansion across 20 properties

- Ather

Energy Ltd

- Issue

Price: ₹321

- Listing

Price: ₹302.40 (5.8% discount)

- Current

Price: ₹418

- Gain:

30%

- Strength:

Strong revenue growth, rapid path to profitability, leadership in India’s

EV sector

Major IPO Losers of 2025

Several IPOs failed to generate returns, highlighting the

risk of focusing only on hype.

- PDP

Shipping & Projects

- Issue

Price: ₹135

- Listing

Price: ₹81

- Loss:

–40%

- Reason:

Weak fundamentals, poor subscription

- Nukleus

Office Solutions

- Issue

Price: ₹234

- Listing

Price: ₹183.35

- Loss:

–21.6%

- Reason:

Cautious business outlook

- Shreenath

Paper Products

- Issue

Price: ₹44

- Listing

Price: ₹35.20

- Loss:

–20.0%

- Reason:

Sector struggles, lackluster demand

- Retaggio

Industries

- Issue

Price: ₹25

- Listing

Price: ₹21.20

- Loss:

–15.2%

- Reason:

Poor post-listing investor interest

- ATC

Energies Systems

- Issue

Price: ₹118

- Listing

Price: ₹101.65

- Loss:

–13.9%

- Reason:

Sector volatility, profit-booking

Top 5 Gainers & Losers Table

|

Rank |

Company |

Sector |

Listing Gain/Loss (%) |

Current Price (as of Apr/Aug 2025) |

|

1 |

Quality Power Electrical Eq. |

Power Equipment Manufacturing |

+84% |

₹784 |

|

2 |

Tejas Cargo India Ltd |

Logistics |

+66% |

₹279 |

|

3 |

Grand Continent Hotels |

Hospitality |

+59% |

₹147.10 |

|

4 |

Ather Energy Ltd |

Electric Vehicles |

+30% |

₹418 |

|

5 |

Rikhav Securities |

Financial Services (Brokerage) |

+90% |

– |

|

PDP Shipping & Projects |

Logistics |

–40% |

– |

|

|

Nukleus Office Solutions |

Business Services (Misc.) |

–21.6% |

– |

|

|

Shreenath Paper Products |

Paper Manufacturing |

–20% |

– |

|

|

Retaggio Industries |

Retail (Apparel) |

–15.2% |

– |

|

|

ATC Energies Systems |

Energy Services |

–13.9% |

– |

Trends, Sector Insights & How to Invest

- Booming

Sectors: Electricals, logistics, hospitality, financial services, and

electric vehicles have led high-performing IPOs thanks to solid

fundamentals.

- Lagging

Sectors: Paper, business services, and energy solutions saw weaker

listings — signifying the vitality of research beyond oversubscription

hype.

- SMEs

Outperform: SME platforms recorded massive oversubscription and strong

listing gains, while mainboard IPOs had mixed results.

- Strategy:

Focus on strong earnings growth, market leadership, and sector positive

trends rather than just subscription figures or celebrity brands.

Conclusion

2025’s Indian IPO market demonstrates that robust

fundamentals, sector momentum, and smart investor research are key to picking

blockbuster winners — not falling for overhyped duds. As India gears up for

headline listings (such as Ather Energy and Reliance Jio), disciplined

selection and post-listing monitoring can deliver outstanding rewards.

Disclaimer: This post is for informational and

educational purposes only. Please conduct thorough research before making

investment decisions. Past performance does not guarantee future returns.