Bajaj Finance Rallies, Hits 52-Week High — What Investors

Need to Know

Introduction

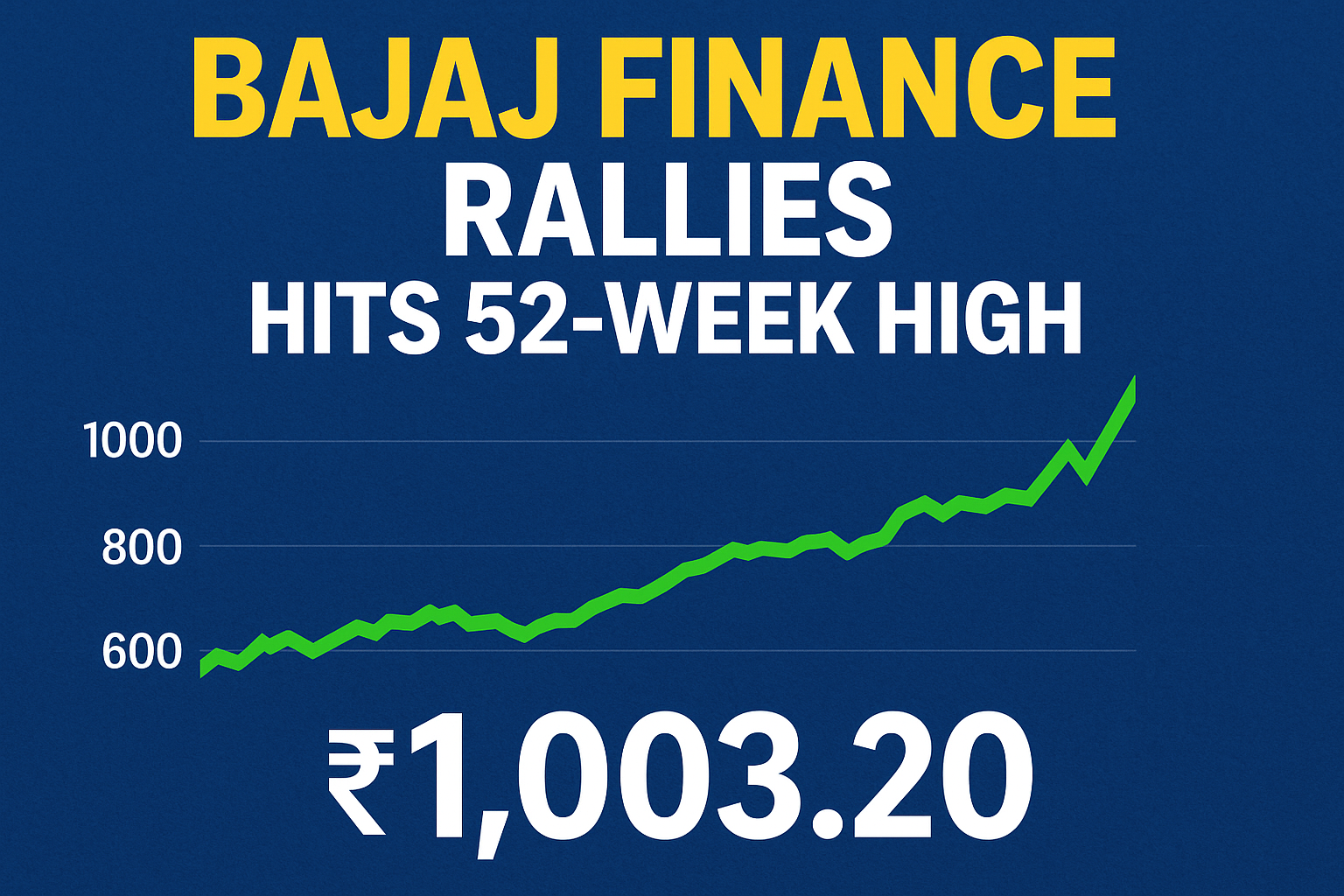

Bajaj Finance Ltd., one of India’s leading NBFCs, has

recently hit a 52-week high, sparking major interest among investors. On

12 September 2025, its share price surged past previous levels to close

above ₹1,000 on the BSE. This comes as broader markets also rise, with the Sensex

index today showing strength. In this article, we’ll cover what’s behind

this move, historical context, impacts, opportunities, risks, and what market

experts are saying. For those tracking Sensex market updates and Sensex

live news, this story is especially relevant.

Recent News

- Bajaj

Finance saw a 3.41% rally on 12 September, reaching a new 52-week

high of ~₹1,003.20.

- Much

of the gain was fueled by heavy trading volume and positive market

sentiment.

- One

trigger: Allotment of Non-Convertible Debentures (NCDs) worth ₹1,350

crore via private placement.

- The

stock is up significantly year-to-date (~44%) and has seen strong

month-over-month gains.

Historical Background

To understand the significance of this 52-week high, here’s

where the stock has been:

|

Time Frame |

Price / Level |

Notes |

|

52-week high before recent move |

~₹978.59 |

Reached on 9 June 2025. |

|

52-week low |

~₹645.10 |

The low point in past year. |

|

1-month trend |

+ ~17% gain |

Recent uptrend ahead of hitting high. |

|

YTD (year to date) |

~ +44% |

Strong year for Bajaj Finance. |

The stock has shown consistent strength in its lending

business, and the broader NBFC sector has benefited from interest rate

expectations, credit demand, and improved investor sentiment.

Impact on Investors & the Economy

For Investors:

- Gains

in Bajaj Finance contribute positively to portfolios heavy in

financials/NBFCs.

- Hitting

a 52-week high often triggers technical interest and may attract momentum

traders.

- The

rise can also bring attention from FPIs (foreign portfolio investors),

which influence Sensex live news and Sensex market updates

given their large flows.

For the Economy / Market:

- Strong

performance by a major NBFC suggests credit demand is robust, which is

bullish for consumption, housing, EMI finance, etc.

- Since

Bajaj Finance is a BSE Sensex component (financial sector), its gains help

lift the Sensex. Sensex’s upward movement (for instance closing at

~81,904.70 on that day) reflects the positive mood.

- Investor

sentiment across financials, especially NBFCs, gets a boost — which can

have spillover effects on similar stocks.

Opportunities & Risks

Opportunities

- Momentum

Play: Traders may see potential for further upside if Bajaj Finance

maintains momentum and breaks past resistance levels.

- Improved

Yield via NCDs: With the private placement of NCDs, investors have an

alternate fixed-income opportunity with decent coupon rates (7.24% p.a.)

for specified tenures.

- NBFC

Growth: As interest rates stabilize or decrease, NBFC net interest

margins (NIMs) can expand. Bajaj Finance, being well-established, is

positioned well.

- Diversification:

With gains in financials and NBFCs, portfolios could rebalance toward

segments that benefited.

Risks

- Valuation

Stretch: At new highs, valuations are often elevated; risk of

correction if earnings fall short.

- Rate

Sensitivity: NBFCs are sensitive to interest rate moves. A surprise

hike by RBI or global rate pressures can reverse gains.

- Credit

Risk: NBFCs carry inherent credit risk, particularly if macro

conditions worsen. Non-performing assets (NPAs) or defaults affect

profitability.

- Profit

Taking / Volatility: High volatility is likely near resistance zones

or after sharp run-ups.

Market Expert Views

Here are some observations from analysts and experts:

- Many

analysts believe the NCD allotment and strong credit demand are credible

catalysts behind today’s rally.

- Some

suggest that Bajaj Finance’s consistent fundamentals, strong earnings

track record, and brand value give it an edge even when markets are

choppy.

- Technical

analysts are pointing out that breaking above ₹1,000 is psychologically

significant and may unlock further upside if sustained volume supports the

move.

- On

the flip side, some caution that overreliance on momentum without fresh

drivers (new business, margin expansion, regulatory clarity) may invite a

pullback.

Future Outlook

What to watch in upcoming months, especially with respect to

Sensex index today and Sensex live news:

|

Time Frame |

Key Drivers |

Expected Trends / Levels |

|

Short term (1-3 months) |

Quarterly earnings, credit growth, interest rate cues,

global signals |

Could see a test of near-term resistance slightly above

₹1,020-₹1,050 if momentum holds; some consolidation likely if broader market

weakens. |

|

Medium term (3-12 months) |

RBI policy, NBFC margin improvements, macro stability,

regulatory environment |

Bajaj Finance may continue outperforming peers in NBFC

sector; potential for further gains if loan book expands and asset quality

stays clean. |

|

Long term (1-3 years) |

Digital lending avenues, financial inclusion,

inflation/rate cycles, economic growth |

Strong structural upside; but returns will depend on

execution, competition, regulatory risks. |

FAQs

Q: How does Bajaj Finance’s rally affect the Sensex index

today?

A: As a major NBFC, its share price rising contributes positively to the

financials component of Sensex. Strong performance by Bajaj Finance boosts

market sentiment, which is often reported in Sensex live news.

Q: What made the stock hit a 52-week high?

A: Key factors include heavy buying volume, solid financials, plus the NCD

allotment news. Also broader favorable conditions for NBFCs and financials

contributed.

Q: Is this a good time to buy Bajaj Finance?

A: It depends on your risk profile. If you're comfortable with momentum

investing and volatility, there may be upside. If you prefer safety, you might

wait for a pullback or better entry. Always check earnings, valuations.

Q: How does interest rate policy impact Bajaj Finance?

A: Lower interest rates help reduce borrowing costs and improve net interest

margins. Conversely, rate hikes or tighter liquidity can squeeze margins or

increase defaults.

Q: What should long-term investors focus on besides price

movements?

A: Book growth, asset quality (NPAs), margin expansion, loan portfolio

diversification, cost of funds, and regulatory changes. Also track Sensex

market updates to see how it performs relative to benchmark indices.

Conclusion

Bajaj Finance’s recent rally and breaking of the 52-week

high is a strong signal of investor confidence in NBFCs and financials. For

anyone following Sensex index today and Sensex live news, this

move underscores strength in the market, particularly financial stocks. While

near-term momentum looks positive, staying cautious about valuation and macro

risks remains important. If earnings and fundamentals follow through, Bajaj

Finance could continue to lead, contributing to Sensex’s ascent in the coming

sessions.