Introduction

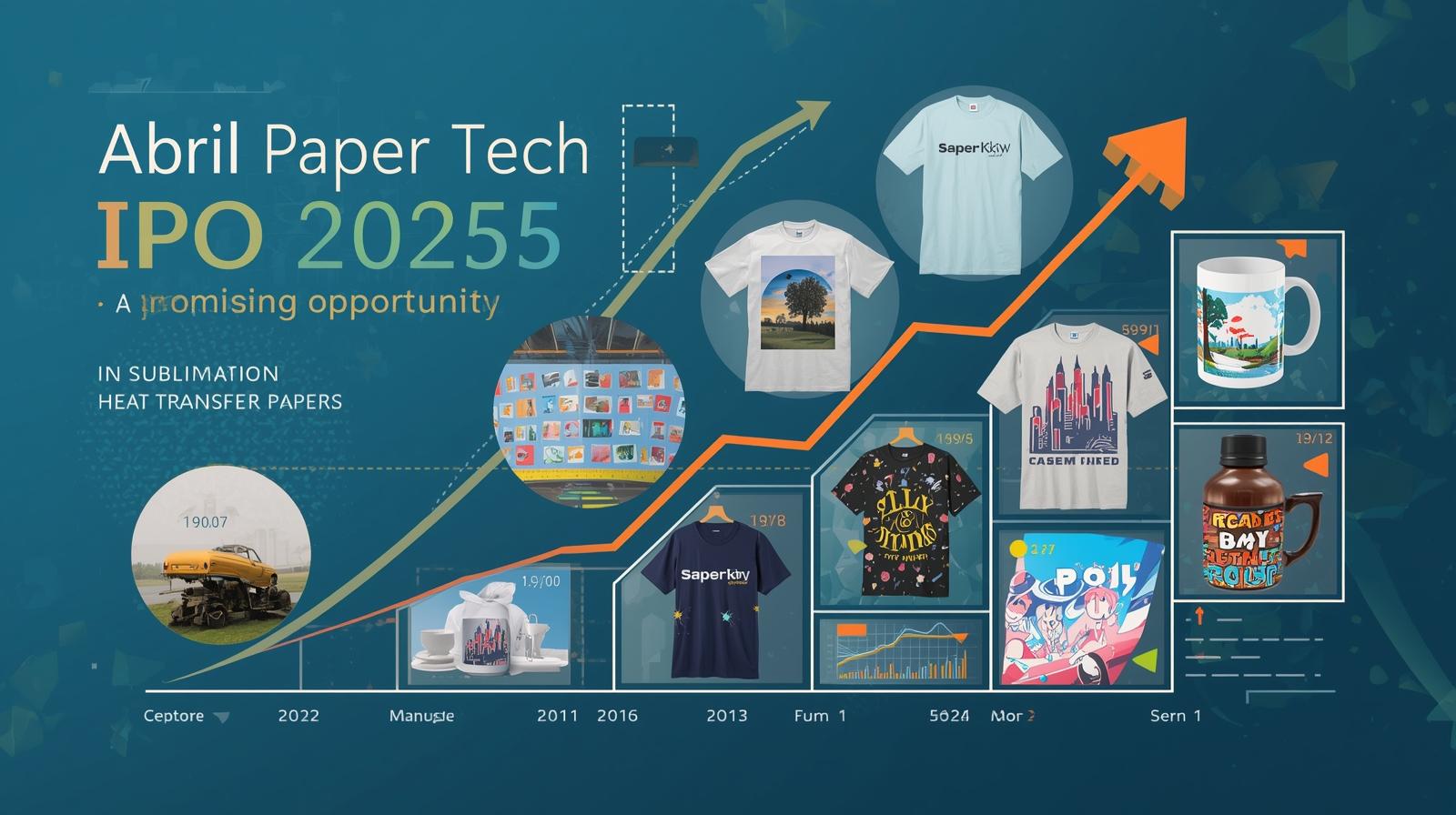

Abril Paper Tech Ltd, based in Surat, Gujarat, is a leading manufacturer and supplier of sublimation heat transfer paper in India. Known for its superior quality products, Abril Paper Tech caters to diverse industries such as digital printing, fashion apparel, home furnishing, and textile printing. The company recently launched its SME IPO to raise ₹13.42 crore, aiming to expand its production capacity and strengthen working capital.

Abril Paper Tech IPO Overview

Abril Paper Tech’s IPO opened for subscription on August 29, 2025, and closes on September 2, 2025. This is a fixed-price issue with a price band set at ₹61 per share. The IPO offers 22 lakh equity shares, with no offer for sale, making it a fresh issue. The minimum lot size is 2,000 shares, with retail investors needing to invest a minimum of ₹1.22 lakh. The company’s IPO listing is scheduled for September 5, 2025, on the BSE SME platform.

Financial Highlights and Growth

Abril Paper Tech has demonstrated impressive growth, with revenue soaring from ₹6.83 crore in 2024 to ₹60.91 crore in 2025. The profit after tax (PAT) also witnessed a significant rise, from ₹0.43 crore to ₹1.41 crore in the same period. The company’s strong financials and growth trajectory showcase its potential for scalability and profitability.

Use of IPO Proceeds

The IPO proceeds will be primarily used to:

• Install two fully automatic sublimation paper coating and slitting machines, increasing annual production capacity from 600 lakh meters to 1,450 lakh meters.

• Strengthen working capital requirements.

• Cover general corporate purposes and IPO-related expenses.

Competitive Advantages

Abril Paper Tech stands out in the market due to:

• High product quality and consistency.

• Wide geographical reach in India.

• Sustainable and eco-friendly manufacturing practices.

• Technological advancements in production processes.

• Strong brand reputation in the digital textile printing industry.

Risks to Consider

Potential investors should consider risks such as:

• Operating primarily from a single manufacturing facility in Gujarat, which poses geographical concentration risks.

• Dependence on a limited number of suppliers.

• Raw material price fluctuations and supply chain vulnerabilities.

• Pending litigation and demand-repayable unsecured loans from promoters.

Conclusion

With its promising financial performance, strategic expansion plans, and a strong market position, Abril Paper Tech’s IPO offers an attractive opportunity for investors interested in the niche sublimation heat transfer paper sector. The IPO aims to fuel the company’s growth and capacity enhancement while maintaining its commitment to quality and sustainability.